|

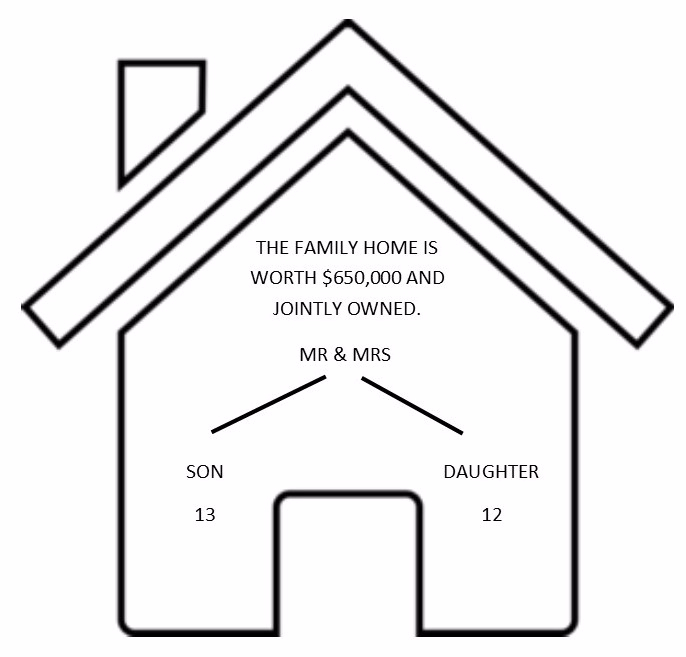

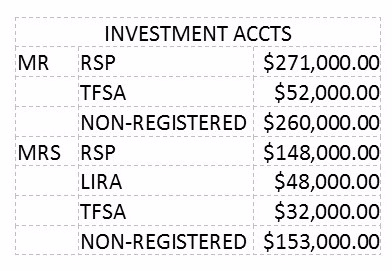

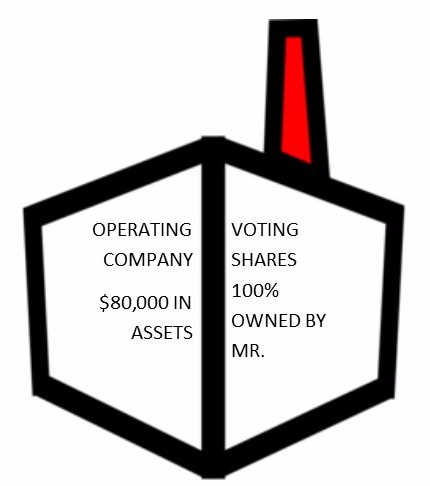

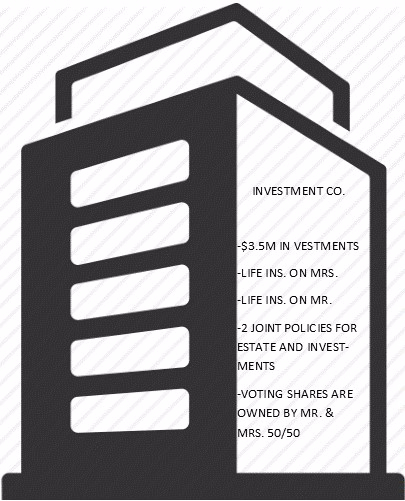

Our Scenario family lives in Ontario. Mr owns Operating Company, which generates approximately $500,000 in revenue per year. He takes $152,000 in salary. Mrs is a professional, earning $180,000 per year in salary. Total family expenses are $120,000 per year.

This seems like a good news story, financially. Careers are stable, living expenses are below incomes, and savings rate is high. Mr and Mrs don’t have wills or power of attorney. They’ve had initial conversations with their investment advisor and with a lawyer. They got stalled in a few questions from the lawyer, and haven’t been back to see her.

In Canada, each province has rules for asset division and estate settlement if someone dies without a will. This is known as “intestate”. We may want our surviving spouse to inherit our assets and continue to parent the children with the values we had before our death; without a will, this isn’t what will happen.

Mr dies suddenly without a will.

After the settlement process, using the intestate laws in Ontario.

- Mrs inherits $1.37M.

- Son has a trust fund of $480,000, to be paid out to him fully by age 18.

- Daughter has a trust fund of $480,000, to be paid out to her fully by age 18.

- $542,000 has been paid to CRA through Mr’s final tax returns.

- Operating Co. has no voting shareholder, and no instructions.

- Investment Co. has lost a voting shareholder, has no instructions on Mr’s shares, and is still holding investments, life insurance proceeds and 3 in-force life insurance policies.

Mr dies suddenly, after completing wills leaving his assets to Mrs.

- Mrs controls all the assets

- $2,300 has been paid to CRA through Mr’s final tax returns.

This scenario is not about financial devastation after the loss of an income-earning spouse. Financially, the surviving parent is stable, and can maintain the family’s lifestyle after the loss. This scenario is about loss of financial control, as the children will have access to a significant amount of money in their own names.

The loss of financial control is preventable, through executing a will that reflects your values in a legally sound way.

Disclaimer- the above example is a hypothetical situation for illustration purposes only and is not to be considered legal advice. Intestate rules vary from province to province. For legal advice specific to your situation, drafting and execution of your wills, please consult your lawyer.

Intestate in Ontario

How an Estate may be administered if a minor child has a claim under an Intestate Estate

To discuss your current situation and estate goals, please contact [email protected] to book an appointment

|