|

Fixed expenses- the money that you’ve already spent based on the choices that you’ve made. These expenses are scheduled to go out at a regular time in a roughly regular amount. The exceptions to the ‘regular time, regular amount’ rule are costs to maintain your house (if you own) and your car. These expenses are less predictable in a short time period, but ARE predictable over a longer time period. The other truth about these expenses is that they WILL happen. If you own your home, you can put off some maintenance for some amount of time, but you can’t put maintenance off forever. Same with your car- the first few years of a new car are often pretty low-expense on the maintenance side. Then expenses will rise. Plan for this; it’s not a surprise. You own the thing, you need to maintain the thing. Your fixed expenses are not the only required costs that you have, however, if you want to organize your spending & saving in a sustainable way, you need to know what you’ve already committed to and what expenses you can make day-to-day choices on.

To find these expenses, take a look through your bank statements and credit card statements for the past 12 months. You are only looking for 'regular time, regular amount' expenses. Don't total all of your spending; some cateogries that occur regularly are going to be omitted in this exercise because the amount varies enough that the category will throw off you feeling in control of your money.

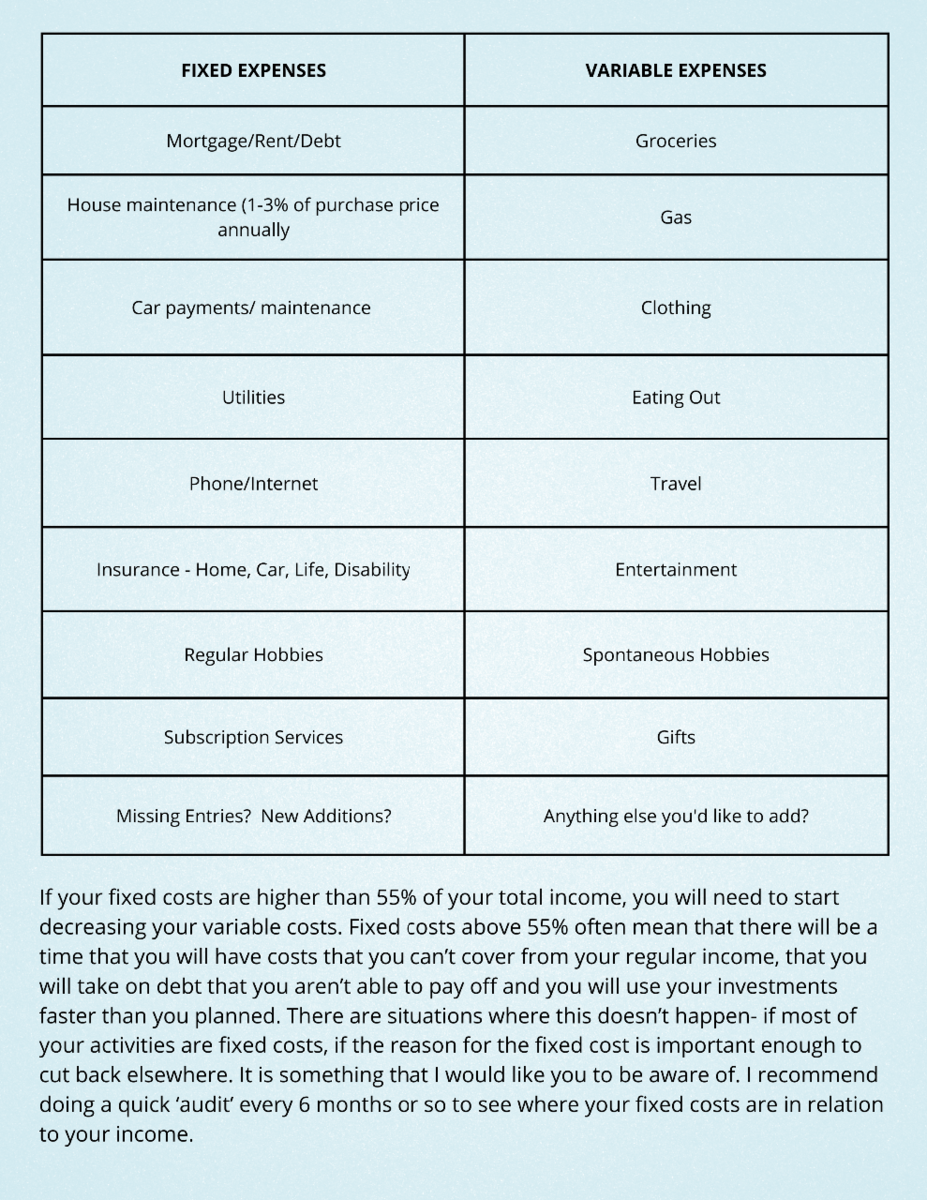

Use the chart below as a guide: expenses listed on the left are fixed expenses- that's what you're looking for in this step. Expenses on the right are variable- leave those off for now. There's a few situation-specific exceptions that may make sense to you- if you use a meal delivery service, that's a fixed cost- you know how much is leaving your account to cover that decision. Using the meal service moves it from a variable (grocery) to fixed (contract) expense. If you commute for work, and know your gas costs, maybe it should go on the fixed expense list. Be careful about adding too much to the fixed list, unless you really wanted a full budget experience! If you do, great- use both sides of the chart and brak out all your transactions for the past 12 months. If you want a faster solution, focus only on your fixed expenses.

Once you've totalled your fixed expenses for a month, including due dates, line those up against your income deposits. You'll start to see where they line up, and where they're giving you trouble. You'll also start to see how much money is available from each pay period/ income deposit to cover your variable expenses.

|