|

If organizing your finances has moved to the top of your priority list, that’s great news. If you’re feeling confused & frustrated about your finances and would rather pull your own eyelashes out instead of dealing with them, but, it’s a new year and tips are everywhere you turn, I’m glad you’ve read this far.

The majority of work that I do with clients involves the foundational work related to money in/ money out. You need to know these numbers before you start making changes. You need to know what’s happening now to make effective choices that will move you to a better place over time.

If you need a new look at your money and are ready to do some math, this post will give you a framework for understanding where you are now and what changes will improve your situation.

Step One: knowing how much is coming in and when

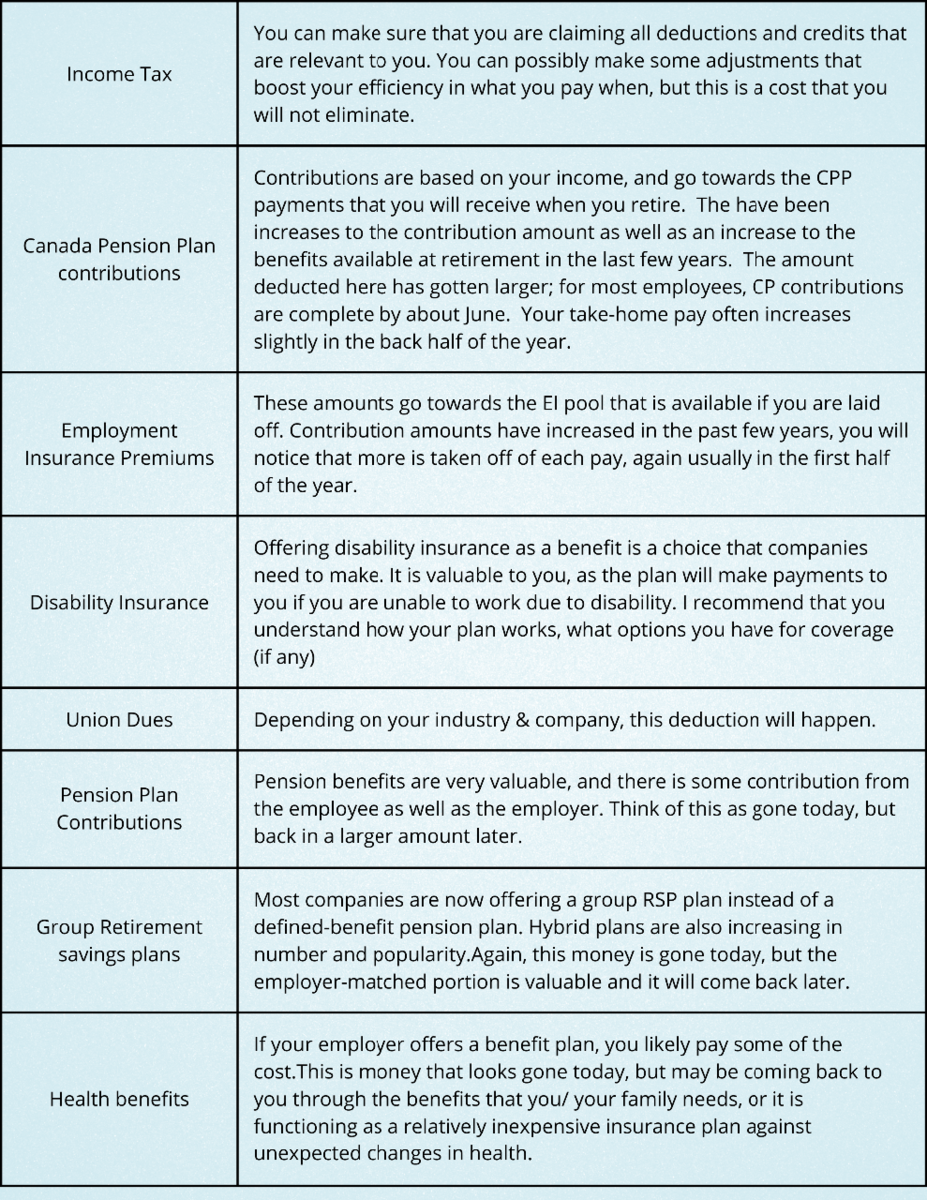

You need to know how much is deposited to your bank account and when that happens. When we try to untangle our finances, we often talk about our salary. In this context, that is not a useful number. None of can make choices on the full amount of our salary. There are deductions before any money lands in our bank account. Sometimes the deductions are large. And valuable.

I recommend that you look back at a payslip from 2022- look for the net amount deposited, or if you have your last payslip, find the year-to-date (YTD) net amount. That will tell you how much lands in your bank account. This is the amount that you need to focus on when you’re asking questions about what’s affordable.

Draw out the timing of the deposits so that you can compare your deposits to when your expenses happen.

See the chart below for a list of common deductions and an explanation of the benefits to you. Need more clarification on what's happening in your specific situation? Contact Sara for an appointment by booking an initial consultation here

or send an email

check back on Jan 23 for Step Two: finding your fixed expenses

|