Building Blocks: Intentional Finances

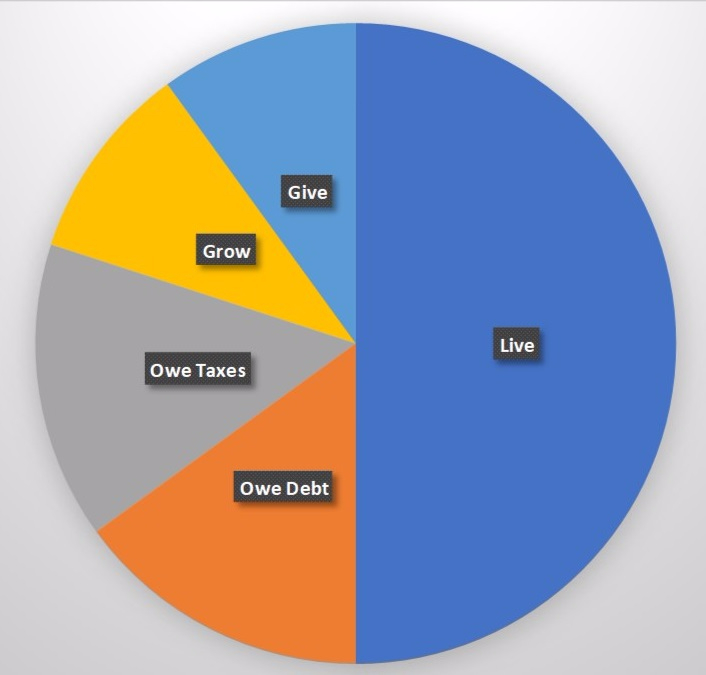

We all have goals, and we’ve all seen an advertising slogan about needing a map to arrive successfully at our desired destination. Today’s graphic is useful for those who would like a clearer picture of their finances, or who have experienced significant change recently. To move towards the goal of helping your children understand and successfully manage finances, this simple illustration covers a lot of ground. This week’s post is Part 1 of 2- check back next week for thoughts on how to clarify your financial values for yourself, then teach your children using concrete examples.

- LIVE- anything spent that supports your lifestyle would go in this category. It is the largest category, however, if ‘Live’ exceeds 50% of your gross (total before taxes) income, I recommend that you look more closely at where your money is going- that percentage puts you are risk if there is a sudden change in your income or needs. If you are starting at the beginning of understanding your finances, leaving this category for last may be easier- all of the other categories are more defined. ‘Live’ is what’s left over after you meet the other 4 categories.

- OWE-Taxes and Debt- taxes are a function of our income; the percentage here will vary depending on your personal and family income situation. Sometimes adjustments can be made to be more efficient here, but at the end of the year, they are symptomatic of income. Debt is more in our direct control. Debt restricts our future choices, and needs to be managed according to circumstance and personal preferences. The percentage of gross income that debt commands should be reviewed; I recommend reviewing options if debt payments are at 20% of gross income and/or if debt is continuing to increase through monthly shortfalls.

- GROW- growing your savings is the only way to meet long-term goals. Setting aside money regularly for maintenance of house and car, goals such as children’s education or a family vacation, and retirement. As you become more familiar with your ‘Live’ and ‘Debt’ pieces, you will be able to choose how much income goes into this piece.

- GIVE- this piece includes any amounts that are given outside of your immediate family. Please do not include amounts that are given to children here; that amount would be included in ‘Live’. The importance of this piece is it’s relation to your financial values, the control that it gives over the whole financial picture and the benefit to those who receive your gift. Think of this as the ‘tiny but mighty’ lever that you can use to push other pieces over to where they will meet your goals faster.

For specific questions and/or a review of your personal situation, please contact [email protected] to book a phone or in-person consultation.

As always, consult your tax professional for specifics related to tax matters.

Graphic used with permission from KA Inc, ©Ron Blue Library LLC 2016

|