|

As this school year wind down, for some families, there will be significant change in a few months. For high school graduates moving on to post-secondary education, there are many hopes and fears.

For parents with Registered Education Savings Plans, there is relief that you have money available, and often uncertainty about how to access it. This post is a primer on how to use the money that you’ve saved and how any withdrawals will be treated for tax purposes.

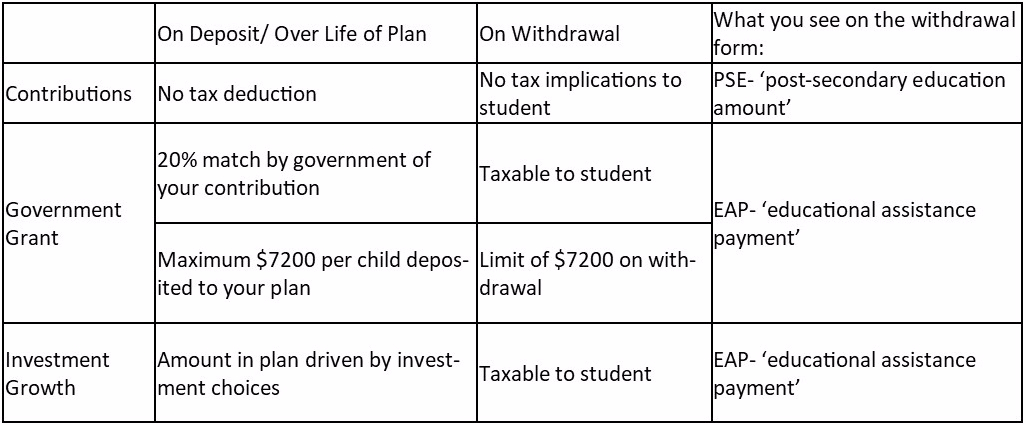

When you were putting money in to the RESP and tracking it’s growth, you looked at 3 different amounts or ‘buckets’: your contributions; government grant amounts and investment growth. On withdrawal, the government allows for 2 buckets- Post-Secondary Education Amount and Educational Assistance Payment.

For example, your RESP account has $7200 in grant money and $10,000 in investment growth. If your withdrawal form indicates $5,000 in EAP, that amount will be removed from the RESP to your bank account. You will receive a follow up letter from the government letting you know how much of that $5,000 is grant. The remainder is investment growth. There is no way to ask that all of the $5,000 be taken from the grant money, even though there is more than $5,000 in grant in the account.

As you can see in the chart above, PSE is the non-taxable contribution amounts that you deposited. EAP are the 2 amounts that are taxable to the child. As the owner of the account, you can not separate the grant money and the investment return. When you submit a withdrawal form, the government has a formula that will indicate how much of the withdrawal is grant and how much is investment return.

Your financial institution can review the 3 different amounts with you and help you understand the implications of each type of withdrawal. Remember to review the specific investment holdings within that account- you will need to sell investments to generate cash for the withdrawal; your investment advisor should ensure that remaining investments meet your goals. Once your student starts withdrawing, the timeline for investments becomes quite short; holding investments that change in value quickly when you know you need the money within 2 years can mean that you don’t have funds available when you need them.

To discuss your education funding goals for your family, please contact [email protected] to arrange a meeting.

The above is an illustration for planning purposes only. For advice related your specific situation, speak to your accountant and investment professional.

CRA website- RESP info

Employment and Social Development Canada

Additional Explanation of RESP withdrawals

*caveat- other blog posts on this site are less helpful

|